Rumored Buzz on Hard Money Atlanta

Table of ContentsHard Money Atlanta Things To Know Before You BuyThe Definitive Guide for Hard Money AtlantaHard Money Atlanta - The FactsTop Guidelines Of Hard Money Atlanta

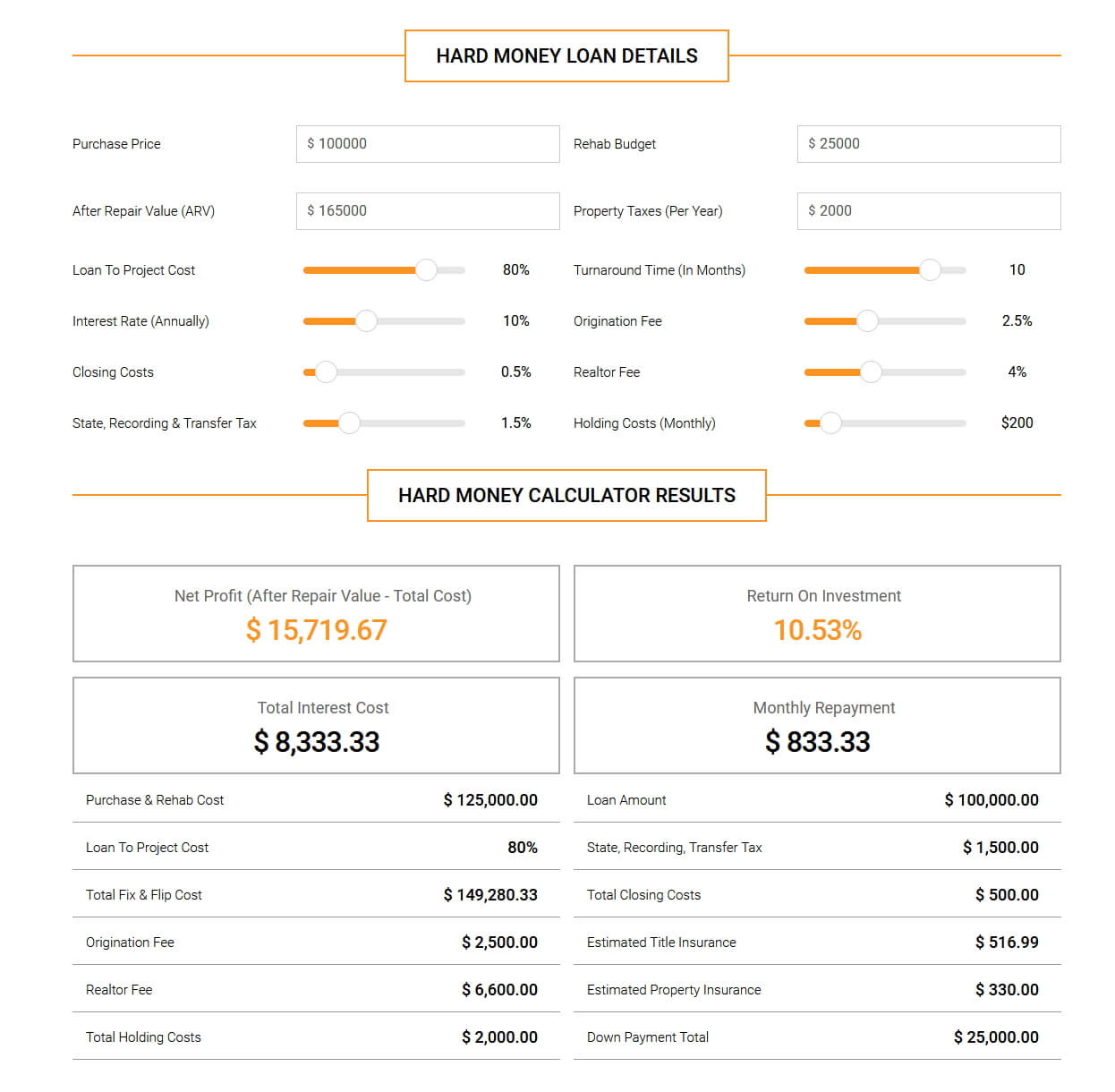

Given that difficult money financings are collateral based, additionally understood as asset-based fundings, they call for minimal paperwork and also allow financiers to close in an issue of days. These fundings come with even more threat to the lender, and for that reason need higher down repayments as well as have greater passion prices than a traditional finance.Along with the above break down, tough money loans as well as standard home loans have various other distinctions that identify them psychological of financiers as well as loan providers alike: Difficult money finances are moneyed quicker. Numerous traditional fundings might take one to 2 months to shut, however tough cash finances can be enclosed a few days.

Conventional home mortgages, in contrast, have 15 or 30-year repayment terms on standard. Hard money financings have high-interest prices. Many tough money car loan interest prices are anywhere between 9% to 15%, which is substantially higher than the passion price you can anticipate for a typical home mortgage.

This will consist of purchasing an appraisal. You'll receive a term sheet that describes the funding terms you have been authorized for. When the term sheet is authorized, the lending will be sent out to handling. Throughout funding processing, the lending institution will certainly ask for files and also prepare the loan for last finance testimonial and also timetable the closing.

Facts About Hard Money Atlanta Uncovered

You'll need some funding upfront to certify for a tough money lending as well as the physical home to serve as security. In enhancement, tough cash fundings generally have higher interest rates than standard home mortgages. hard money atlanta.

Common departure strategies consist of: Refinancing Sale of the asset Payout from other resource There are lots of circumstances where it might be advantageous to use a tough cash car loan. For starters, investor who like to house flip that is, buy a rundown house in requirement of a whole lot of work, do the work personally or with contractors to make it extra valuable, then transform around and also sell it for a higher rate than they purchased for may find hard money financings to be perfect funding options.

Because of this, they don't require a lengthy term and also can prevent paying too much passion. If you buy investment residential or commercial properties, such as rental properties, you might also discover tough money loans to be great choices.

Rumored Buzz on Hard Money Atlanta

In some cases, you can likewise utilize a hard cash lending to buy uninhabited land. This is an excellent alternative for developers who are in the process of getting a building and construction financing. hard money atlanta. Note that, even in the above situations, the potential drawbacks of hard money loans still use. You need to make certain you can repay a tough cash financing prior to taking it out.

While these types of loans might seem challenging as well as intimidating, they are a generally used funding approach numerous genuine estate investors utilize. What are tough money loans, as well as just how do navigate to these guys they work?

Tough cash car loans normally come with higher rate of interest rates as well as shorter repayment schedules. Why select a tough money loan over a traditional one?

Our Hard Money Atlanta Statements

Furthermore, since private people or non-institutional lenders use difficult cash lendings, they are exempt to the very same laws as traditional lenders, that make them a lot more high-risk for customers. Whether a hard money loan is best for you depends upon your scenario. Tough money fundings are excellent alternatives if you were denied a conventional finance and also require non-traditional financing.

Contact the experienced home loan consultants at Right Beginning Home Mortgage to learn more. Whether you want to buy or re-finance your house, we're below to aid. Start today! Ask for a free customized rate quote.

The application procedure will typically involve an assessment of the residential property's worth and capacity. By doing this, if you can not afford your repayments, the hard money lender will merely move in advance with view it now selling the residential or commercial property to recoup its investment. Tough cash loan providers usually charge greater rates of interest than you would certainly have on a standard finance, however they likewise fund their lendings quicker and usually call for much less paperwork.

As opposed to having 15 to three decades to pay off the finance, you'll normally have just one to 5 years. Difficult cash finances work rather in a different way than conventional loans so it is necessary to comprehend their terms and what purchases they can be used for. Tough money financings are normally intended for financial investment properties.